As companies address their unique challenges directly related to the impact of the Covid-19 Pandemic, pay is changing dramatically. Employees are greatly concerned with retaining their jobs and their income; employers are greatly concerned with their financial health, ability to meet ongoing expenses, and how to retain the workforce they will need for the future.

The Covid-19 pandemic is having a profound impact on virtually all aspects of our lives including health, economic social and even climate. Employers have had to make policy and program changes in response. Compensation practices has been one area receiving significant attention.

There is no shortage of research and surveys being conducted to understand how employers are changing their pay practices. Highlighted below are two pay-related actions many companies are considering: hazard pay and executive compensation pay reductions.

Implementing Hazard Pay

Not surprisingly, the Covid-19 crisis surfaced the issue of whether employers should pay workers a premium for the risk associated with having to work on-site during the pandemic. This is not just about public facing jobs. Commuting to work also is a hazard for many, if not most.

Hazard pay before Covid-19 was rare at least as a separate element of pay. Jobs requiring physical hardship and risk are typically paid more as part of the core wage rate.

WorldatWork’s COVID-19 Quick Polls study of 267 organizations found two-thirds of respondents “are not planning on offering extra pay (Wilson Group defines as incentives and spot bonuses) but instead will provide “perks” (quotes added) such as meals and daycare options.”

The WorldatWork finding that two-thirds of their sample are not paying incentive or spot bonus forms of hazard pay is not surprising, when viewed through the lens of unemployment rates and financial stress on companies. Instead, they chose to invest in supporting employees reduce costs for primary needs such as daycare and meals.

Some companies have chosen to deliver extra pay by increasing base wages during the pandemic. Amazon, Walmart, Target and JP Morgan have all been reported to have raised wages, typically $2/hour.

Whether $2/hour or perks such as providing daycare and meals is sufficient considering the risk is certainly debatable and ultimately depends on the individual situation. However, few if any business leaders question whether the risk is real. “I don’t want to be in a society where we’re setting up systems for many people to die,” said Pagliuca, who is Co-Chairman of investment firm Bain Capital and a Co-Owner of the Boston Celtics.

Reducing Pay

The economic impact of Covid-19 is unprecedented, forcing employers to layoff and furlough millions of American workers. We have also seen widespread reductions in compensation, especially among executives as leaders look for less draconian ways to reduce costs. Executive and Board pay reductions are also being driven by public relations considerations and a desire to protect the brand.

Pay reductions vary widely, reflecting the ways in which Covid-19 has impacted different sectors of the economy and individual businesses. Caution needs to be used in interpreting and comparing the salary reductions taken by other companies as not all factors related to these reductions have been examined. For example, variation in length of time that salary reductions may remain in place, and companies who may be using non-cash compensation to offset loss of salary or incentive pay, need to be considered.

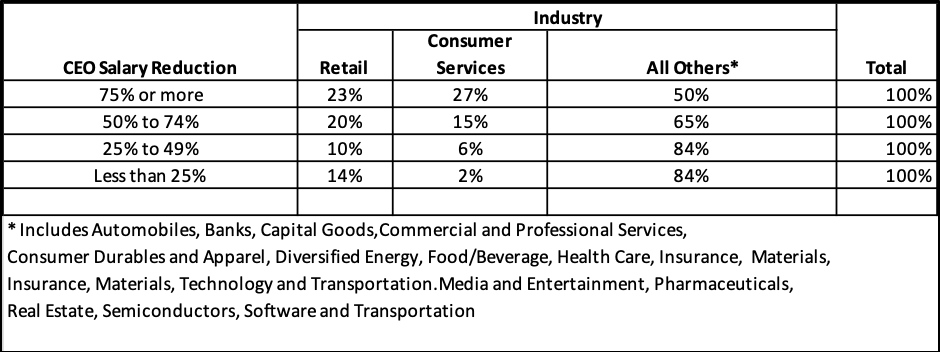

A review of regulatory filings from about 200 companies compiled by a private firm found reductions in CEO salaries were evenly distributed, ranging from a high of 100% to 15% or less. However, closer examination highlights the importance that industry has on CEO pay reductions. As shown below, half of all CEO salary reduction of more than 75% come from Retail and Consumer Services which make up only 35% of the sample. In contrast, 40% of the CEOs in all other sectors received less than a 50% reduction with the majority of these (59%) receiving less than a 25% reduction.

CEO Salary Reductions

Data as of April 9, 2020

Executive pay reductions below the CEO level show a similar pattern, although the size of the pay reductions is smaller. For example, half of the consumer services and retail companies reduced pay for non-CEO executives by 50% to 75% compared to only 32% of other employers. More than half of non-CEO executives in other industries received less than a 25% reduction in salary.

Keep in mind that these statistics only focus on salary. For many executives’ salary only represents about one-third of total compensation, while annual incentive makes up another 20%, long-term incentive accounts for 40% with the remainder of compensation coming from benefits. Executives in many industries may find that their biggest reduction in pay will come from reduced or no incentive payouts for the current fiscal year and reduced payouts for long-term incentive plans especially for those grants made in prior years that are expiring or vesting in 2020. This is especially true for equity grants that are performance vesting tied to external factors like stock price. Companies may be facing an “integrity” question when it realizes how current market conditions will impact the compensation of both their executives and their frontline workforce – should they make payouts or not?

Final Thoughts

Market statistics on pay practices during these challenging times are helpful because they put into context decisions each company is making. However, they do not give us answers on what is the right course of action for any one company. More important than market statistics are the drivers of each organization’s business and their human resource strategy. The actions discussed in this blog reflect this thinking.

Consider hazard pay. From a compensation perspective, we can certainly debate whether employers are not doing enough to compensate individuals for the additional risk of having to work on-site during the epidemic. But will any amount of money be enough? Instead, most employers are addressing quality of life issues by helping individuals navigate their day-to-day activities during these troubled times. This may be even more helpful than a spot bonus or temporary wage increase and is more aligned with business needs. They help employees get back to and focus on work; even though we can debate whether they fairly compensate employees for that work.

Likewise pay reductions for executives are less about cost savings and more about protecting the brand, both from an employer and client perspective. During times of crisis, it’s about being a good corporate citizen. The reductions communicate to employees and customers that we are all in this together.

Pay adjustments should be viewed in the context of the longer-term needs of the business and less about employee recognition and the value of work. Will employers revisit these core principles post-pandemic? Or might they be forced to by worker activism or government intervention? Time will tell.

Wilson Group looks forward to helping you determine your best course of action given the general market conditions and trends, and helping you find and implement the answer you need to survive and prosper in these challenging times. We are ready to work with you. .